Intuit TurboTax 2019 Canada Edition – (PC Software)

Intuit TurboTax 2019 Canada Edition

Intuit TurboTax 2019 Canada Edition: A Complete Guide

Introduction

Year after year, many Canadians find themselves in a stressful and confusing situation when it comes to preparing and filing their annual tax returns. Intuit TurboTax 2019 Canada Edition has finally arrived to shake up the traditionally nerve wracking job and finish it quickly. Their expertise in tax preparation comes from the team of professionals employed by TurboTax, who expertly designed the program. TurboTax, the brand name of the tax preparation software suite, has been the leading tax preparation software that has enabled millions of Canadians to file their income tax with confidence, to maximize their refunds and to comply with the CRA. The 2019 edition was tailored specifically to handle the tax laws and credit changes for the 2018 tax year, making it a relevant and powerful tool for its time.

Intuit TurboTax 2019 Canada Edition – (PC Software)

Overview

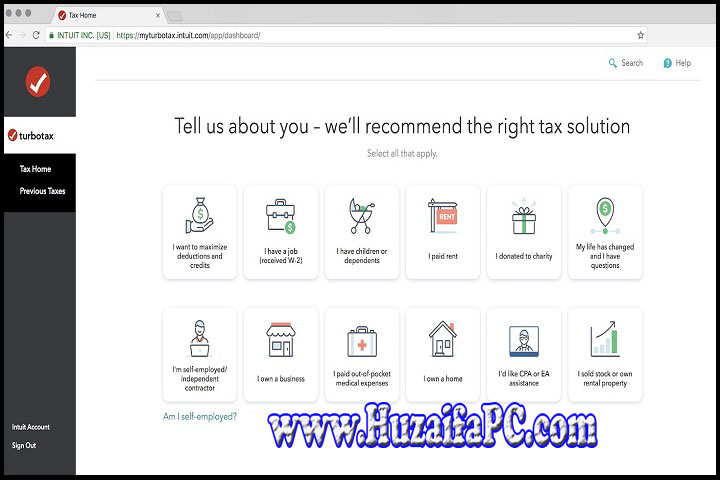

TurboTax 2019 is not financial information for those who lack it! In addition to that book, you don’t have to be an expert your taxes. It supplies commentary in an elementary, word-specific manner. This particular tax software is just concerned with simple, everyday topics, like job, income, and living expenses–the same stuff a tax professional might ask you about in real life. Guided by your responses, TurboTax will select all the necessary forms for you and will fill them in. The program will then look for all the deductions and credits available to you. It is designed for different types of individuals with different financial situations, from the simplest (using T4 slips) to the complex ones like entrepreneurs (seeking investment opportunities), and those that are self-employed.

Description

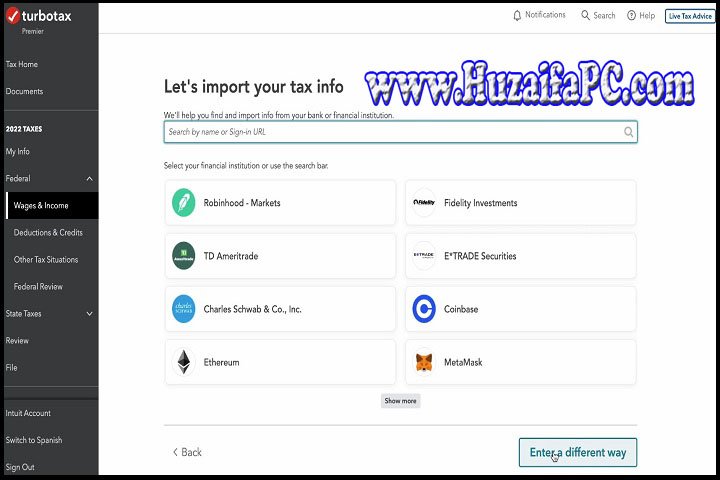

Keying in the filing, you decide the software which symbolizes sheltering TurboTax’s classes—Free, Standard, Premium, or Home & Business, which are each particularized in scope to a tax harmonize. With this program having the hearty authorization of the CRA, this proves to be mind-effortless as your applicable tax slips like T4s and T5s are automatically DROPPed securely into your return less the manual entry. Hence, the chance of mistakes dropped.

Provided that you get registered, TurboTax provides you with thousands of errors to review and ensure that your filing is error-free and presents you with the maximum possible refund under the relevant laws and tax deductions. This specific procedure is based upon scrutinizing the efficient manner in which you have entered the information, by deducting all the incurred taxes, and showing you the real-time calculation of either the return that you will be getting or the balance due. Nothing finally. Your return can be filed online with the CRA in one-click, with most Canadians getting their refunds in 8 business days directly through the deposit.

Key Features

Auto-fill my return: Your personal data sourced directly from the government to ensure both time and accuracy.

Maximize Your Refund Guarantee: This program guarantees you that your refund will be maximized; otherwise, TurboTax will have to give the difference plus an additional $100 recuperation.

Audit Support: With complimentary audit support, it is possible to obtain assistance from a trained expert at any time of the year in case the CRA requires more information regarding your tax return.

Step-by-Step Guidance: Through conversational help, the software will know exactly what you may or do not need so it can cater to your specific situation.

In-Depth Help Resources: The set of informational resources includes the library system, message boards, and consulting services for people with complicated tax issues.

Optimized for Specific Income: The Premier edition advises you on investments and rentals, whereas Home & Business is made for sole proprietors, freelancers — in other words, small business owners.

How To Install

Purchase: Visit both the physical location store and the the online store to be presented with a box of TurboTax 2019 retail CD-ROM packages, both of which are available at any reputable retailer. One could also download the software from the official TurboTax Canada website.

Run the Installer: Begin the process of installing software by inserting the CD into your computer. Click on the installer to guide you through the whole process. Have you downloaded the software? Then, you need to click the button that appears on your screen to start the installation. Look for a file named “Setup.exe” or similar. Once you find it, just double-click it.

Follow the prompts: Your installation is guided through the use of the Installation wizard. You may have to agree with the license agreement and choose an installation location on a hard disk.

Activate: Start-up with TurboTax 2019 to be done. At this point, you will have to do the activation process where software is tied to the unique license code that comes in Retail Box, or you would have received the email confirmation that comes with digital purchases.

System Requirements

To run TurboTax 2019 Canada, the minimum hardware requirements specified below include the following properties:

Operating System: Windows 7, 8, or 10 / macOS 10.12 (Sierra) or later.

Processor: 1 GHz processor or faster.

Memory (RAM): 1 GB of RAM (2 GB recommended).

Hard disk space: 450 MB of available space.

Internet Connection: Necessary for the system set-up, such as activation and software updates, and for internet usage in general, such as the Auto-fill my return feature and neatly.

Others: The CD version ought to have a CD-ROM drive so you can install it in your system. A contemporary browser is also required.

Download Link: HERE

Your File Password: 123

File Version & Size: | 234.8MB

File type: compressed / Zip & RAR (Use 7zip or WINRAR to unzip File)

Support OS: All Windows (32-64Bit)

Virus Status: 100% Safe Scanned By Avast Antivirus